Blog

These write-ups demonstrate our investing approach and process. We suggest focusing on our process in these examples, as this is repeatable. The specific investment thesis and outcome were unique to that company at the time, hence not repeatable.

Our process is not perfect. We too have experienced unsuccessful investments in the past, like Fingerprint Cards or L Brands in recent years. Here is how we mitigate their impact.

Setting the bar high. We don’t buy anything that we don’t see as a likely double in 3-4 years, and without making over-optimistic assumptions. This eliminates 9 out of 10 opportunities that we investigate.

Scaling into positions. We prefer to scale into our investments as new facts demonstrate that our thesis is gathering momentum. This way our capital is weighted towards higher-conviction opportunities.

Diligent monitoring. We carefully monitor company evolution against our thesis for each position in our portfolio. If the evidence reveals a “broken thesis” we then move quickly to cut exposure, even if we take a short-term loss.

Capital management. We regularly rank our current investments against watchlist opportunities on a risk/reward basis. If a new opportunity is clearly superior to an existing investment, then we re-deploy capital accordingly.

These processes together ensure that we exit unsuccessful investments quickly, and our portfolio evolves towards higher-quality opportunities over time.

What do the US Fed rate hikes mean for investors and businesses?

By Anand Batepati | 16 Jun 2022

This week, stock markets fell hard and into bear market territory in anticipation of a big Fed rate hike. Here is how to put it in perspective.

“Interest Rates” generally mean the full yield curve, starting from the interest rate for overnight lending/borrowing of US Treasuries to 2yr, 10yr, 30yr. Market value of all USD assets is linked to this.

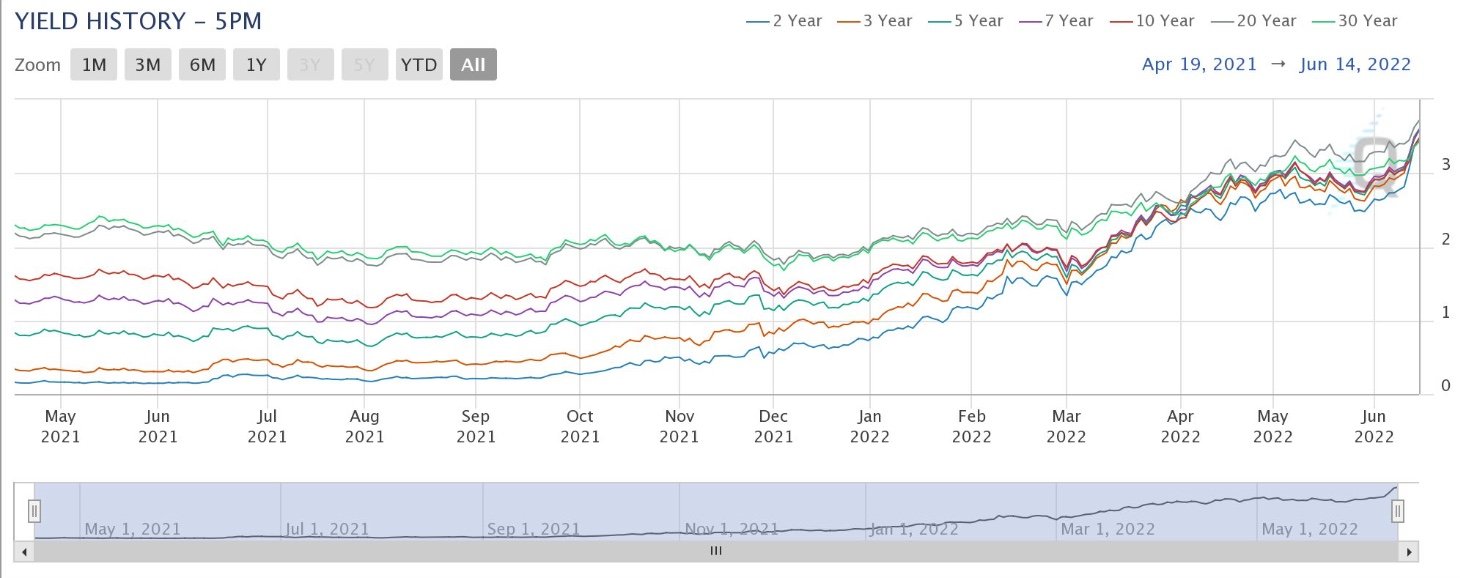

This “yield curve” is backed out from US Treasury bonds. The chart below shows how rates across maturities have increased, flattening the curve. Big!

The Fed controls the rate for a “1-day to maturity US Treasury Bill”, known as the “Fed Funds” rate. This is what is being hiked/cut by the Fed.

The Fed Funds futures (a derivative instrument) is heavily traded, and the “market implied” expectations of Fed Funds at a later date can be backed out from their prices. This is what people refer to as “being priced in” when they talk about rate hike expectations.

However, the Fed only controls this one single point of the yield curve. The other points – 2yr, 10yr, 30yr maturities, are determined by market forces, not the Fed.

Think of the yield curve as a string that is floating in the air at the long-dated end and being held by the Fed at the short-dated end. As the Fed shakes the short-dated end up and down, ripple effects are felt across maturities on the curve. This ripple effect is why the yield curve flattened in recent months.

The market-implied 10yr rates, etc., are linked to the Fed Funds rates through that string but are backed out from US Treasury bonds and their derivatives. This so-called “swap curve” is the standard used by banks and institutions.

Here is the current situation.

The next Fed meeting is on June 15, 2022. The Fed Funds rate as of June 14, 2022 is 0.75-1.00%.

Market implied probabilities of Fed Funds rates in the future:

– Jun: 1.50-1.75%: 99.8% probability

– Jul: 2.25-2.50%: 90.6% probability

– Sep: 2.75-3.00%: 63.6% probability

– Nov: 3.25-3.50%: 56.5% probability

– Dec: 3.50-3.75%: 43.9% probability

The market is pricing in a 75 bps hike (0.75%) tomorrow and Fed Funds to be at 3.75% by December (1% today) to bring down inflation.

In the end, you and I don’t care about the Fed Funds rate (the 1-day to maturity borrowing) but the interest rates that manifest in say a 5yr borrowing or a 30yr mortgage. This is what directly affects businesses or stock valuations.

I expect to see elevated volatility in stock markets in the next few days, even though a 75 bps Fed hike is “priced in”.

At GFM Focus Investing, we have gone into defense mode for some time now and are focussed on avoiding drawdowns, while positioning ourselves to gain from elevated volatility.

What does it mean to buy an equity index ETF?

By Anand Batepati | 7 Mar 2022

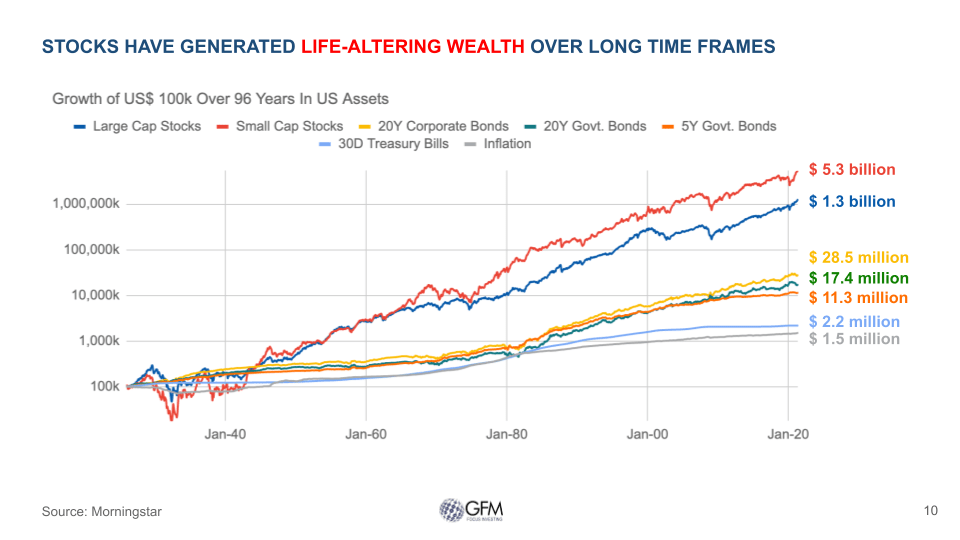

In a recent webinar, I showed that equities had outperformed all other asset classes like bonds, and generated life-altering wealth over long periods.

Someone then asked: ‘This is a fantastic result of investing in equities. But, how can I believe this data given that the average life of a company is around 20 years. If I had bought some stocks long ago, some of them would have died or disappeared. I am not sure that I would have done so well with equity investing given these failures.’

The question is correct but this conclusion is completely wrong.

The misinterpretation comes from not understanding how an equity index works. Therefore, I wanted to share my answer here so others can also benefit.

Let’s take the S&P 500 index. It represents around 85% of the market capitalization of all US-listed stocks, so nearly the entire US stock market.

The index is constructed as follows:

– The S&P committee lists all US-listed stocks and sorts them in descending order of (adjusted) market capitalization.

– They then take the top 500 stocks and include them in the index.

– The percentage weight of each stock in the index is determined as the market cap of that stock divided by the total market cap of all 500 stocks.

This is done every quarter. The adjustments relate to liquidity (float and volumes, which I will skip here for brevity).

So, if you had bought an S&P 500 index ETF in 2000 and held until 2022, $100k invested would have turned into over $300k in value, an excellent result.

Here is how your money would have actually gone to work in that time:

– In 2000, a fifth of your money would be invested in Microsoft, Cisco, Exxon Mobil, GE, and Intel, in that order, accounting for 18% of the index.

– In 2022, a quarter of your money would be invested in Apple, Microsoft, Amazon, Alphabet, and Tesla, accounting for 23% weight in the index.

As Cisco and GE declined over time, the dollar exposure to those two stocks in your ETF would have reduced and your dollar exposure to Apple and Alphabet would have increased.

As some stocks declined over time, your exposure to them would have proportionally reduced and vice versa. The annual portfolio turnover of the S&P 500 has averaged around 4.5% (or 22 years life of a particular stock in the index).

That 100k turning into over 300k is a real result that you can cash out with. Investing through this index would have actually delivered this wealth appreciation, irrespective of whether or not some stocks declined, disappeared, or emerged.

At GFM Focus Investing, we invest with the aim of doubling money every 3-6 years, vs. a double over 9-10 years for the stock market on average. Over a 10 year horizon, the difference in wealth appreciation is huge.Please see this video, 46:50 timestamp, for a snippet of our approach.

“Not Allowed” To Compare Investments?

By Anand Batepati | 18 Feb 2022

In last week’s webinar I compared two of the largest companies in the US in 2016 by market value, Apple and Exxon Mobil, from the perspective of an owner-investor. These were just two of the biggest companies by market value at the time, and not pre-selected by me.

I demonstrated how by using a simple investing framework, you would have seen clearly that Apple was a far better business and has a much brighter future than Exxon Mobil has, given the information publicly available in 2016.

I also showed how by acting on that investment evaluation, investing in Apple stock, and then monitoring the underlying business performance, you would have seen that between 2016-2021 that Apple was going solidly in the right direction while Exxon Mobil was going in the opposite direction.

At the end of five years of walking that path, by 2021, an investment in Apple would have quadrupled your money, whereas that in Exxon Mobil would have cut down your money by half. The overall market would have doubled your money over the same period.

Many in the audience appreciated this point-in-time demonstration of fundamental investing principles to separate good future investments from bad, and without the benefit of hindsight.

One of the questions that I received later was that I am “not allowed” to compare Apple and Exxon Mobil as they are different businesses. One is a tech company and the other is in the oil business. Hence, such a comparison is “unfair”.

My response was that as an investor my goal is to find the best investments, which offers adequate protection on the downside if bad times do come, and which offers substantial upside of my invested capital over time.

My goal is not to find the best tech investment, best oil investment, best German-listed investment or best small-cap investment. Therefore I have learned to, can, and do evaluate stocks in different businesses and ask the questions: Is this an outstanding investment on its own, and is this better risk-reward than my current best investment.

This is just one snippet of our overall investing framework at GFM Focus.

Webinar: If You Want Thrills, Then Trade. If You Want Wealth, Then Invest

By Anand Batepati | 10 Feb 2022

Say that you buy gold biscuits with your savings. The only way you can make money is if you sell it to someone else at a higher price. The gold biscuit by itself doesn’t do anything – it doesn’t generate cash flows or add any economic value – it just sits there.

Trading is about buying an asset in the hope of selling it to someone else at a higher price for a profit, faster the better.

Let’s now say you buy a farm and never sell it. The way you make money is from the farm itself, from the cash it generates. You will work on increasing the cash flow it generates, and you will compare what it generates with how much you paid to buy the farm. If the value of your farmland goes up because of superior yield or urban development, then your wealth goes up too, even if you never sell the farm. This is an investment.

Investing is about buying an asset and looking at the asset itself to generate wealth for you. Investing is both fundamentals-aware (how much cash it can generate) and valuation-aware (how much did you pay to own those cash flows). Investing does not depend on someone else coming along to buy your asset at a higher price.

You can trade a stock many times every day, or you can hold the same stock for a lifetime. Which approach is superior for generating life-altering levels of wealth? In which approach can you put all your life savings and sleep well at night?

In this webinar, we will contrast trading, market timing, and other short-term approaches with long-term investing that we practice at GFM Focus Investing. We showcase how prudent, long-term investing puts the odds of success in our favor and generates significant wealth in a world filled with uncertainty, volatility, costs, and taxes.

Watch our playback here

Was Peloton Ever A Good Investment?

By Anand Batepati | 10 Feb 2022

I was asked about Peloton at a webinar many months ago.

A good investment protects your money from permanent losses when known unknowns and unknown unknowns happen, and it grows your wealth over time.

By that yardstick, Peloton (PTON:US) has been a terrible investment…

We beat the the market, yet again

By Anand Batepati | 26 Jun 2021

We beat the the market, yet again.

Growth of US$ 100 from November 2020 to May 2021:

– Bonds: 100 to 99

– S&P 500: 100 to 129

– Global stocks: 100 to 131

– GFM Focus Investing: 100 to 188

And yes, we have also beaten the market since inception, too. This is the power of Focused, Long-Short Investing.

Focus. We concentrate on the best investments that we know of, after repeated search and research.

Long and short positions. Our long investments usually are event-driven situations or high-quality compounders. Our shorts tend to be structural decliners or stressed companies. This positioning helps us generate returns in both rising and falling markets.

Value and growth. We seek to buy at a large discount to our estimate of the take-private value of a business, after factoring in its growth potential. We value a business as if we are buying 100% ownership of the company forever with all of our family’s money.

How We Tripled Our DELL Investment In 8 Months

By Anand Batepati | 22 Apr 2021

Back in August 2020, I wrote a Barron’s article outlining our long investment case for Dell. At the time, the stock was trading around US$ 50 per share…

Robinhood Is The Target Of Misguided Anger

By Anand Batepati | 2 Feb 2021

Robinhood stopped new opening trades because it didn’t have the cash to put up as collateral with DTCC. It allowed closing trades because those would reduce the collateral required with DTCC.

Does this sound like Greek to you? Read on…

https://www.linkedin.com/pulse/robinhood-target-misguided-anger-anand-batepati/

GameStonk!

By Anand Batepati | 1 Feb 2021

As the GameStop chickens come home to roost, it’s worth mentioning what Investing is and what Trading (Gambling in this case) is…

What is Value Investing? It is NOT About Buying Low P/E Stocks

By Anand Batepati | 30 Oct 2020

Cheap Stock ≠ Value Stock ≠ Good Investment

Expensive Stock ≠ Growth Stock ≠ Bad Investment

How To Build A Fortune Through Investing: Business Quality

By Anand Batepati | 21 Oct 2020

“Business quality” is a vague sounding term, but it is the most powerful source of wealth generation through investment.

We illustrate this concept with a simple example comparing Apple and Exxon Mobil in this article.

https://www.linkedin.com/pulse/how-build-fortune-through-investing-business-quality-anand-batepati/

Dell Technologies (NYQ:DELL)

By Anand Batepati | 21 August 2020

I view Dell’s stock right now as a “heads I win the jackpot, tails I lose very little” type of investment. This is the very characterization of a margin of safety.

Our long investment thesis on Dell Technologies was published in Barron’s, the sister publication of The Wall Street Journal, in August 2020.

Stocks That Generate Millionaires

By Anand Batepati | 19 August 2020

Everybody has heard of Apple and Amazon – stocks that have generated millionaire shareholders. What about Asian Paints, Mercado Livre, MTY Foods, Geely Auto? These then-unknown names too have generated many millionaire shareholders over the years.

Our webinar on how we invest in compounders at GFM Focus was put on Youtube by The Tactical Brief from Germany.

https://www.youtube.com/watch?v=spr0inyGfeE

Margin of Safety: Twitter (NYQ:TWTR)

By Anand Batepati | 15 July 2020

We work hard over a long time to evaluate what a business is really worth and then pay a substantially lower price when stock market gyrations throw up such opportunities.

We think that Twitter today is both a fantastic social network and a complete mess of a business. Let me outline why Twitter offers no margin of safety at stock prices in July 2020.

https://www.linkedin.com/pulse/growing-your-wealth-turbulent-times-margin-safety-anand-batepati/

Event-Driven Long: Wheelock (HKG:0020)

By Anand Batepati | 16 April 2018

China’s property speculation clampdown caused a brutal sell-off of all things real estate. Like the saying goes, invest when there is blood on the streets.

We doubled our money in a year by finding a baby that was thrown out with the bathwater.

https://drive.google.com/file/d/1FhZRZxTq-u_j9AfVI1o_Kg4xEFN0eZKY/view?usp=sharing

High-Quality Long: Infosys (NYSE:INFY)

By Anand Batepati | 12 October 2017

A high-quality, cash-rich services business was available for us to buy at a multi-year bargain price because the hype around the CEO’s resignation caused a market selloff.

We are up 50% on our investment in less than 18 months and are still invested.

https://drive.google.com/file/d/1PbjdQ9jjZVpHFUsnwSxk6YQ7fv_pykE2/view?usp=sharing

Failure Short: Vocus Communications (ASX:VOC)

By Anand Batepati | 13 May 2016

We saw the darling of the Australian stock market for what it was – a house of cards that was close to collapsing under its own weight.

After struggling to survive the short bleed in the early days, we made over 50% in 1-year on our short position.

https://drive.google.com/open?id=100XCIHcIMnkNaFhukoSFGVeBs-DoIhrj